what does your credit score have to be to buy a house

Jumbo home loan requirements. Ad See Your Credit Report Absolutely Free Credit Score.

Knowing Your Credit Score Buy House And Property Intelligently Homeia

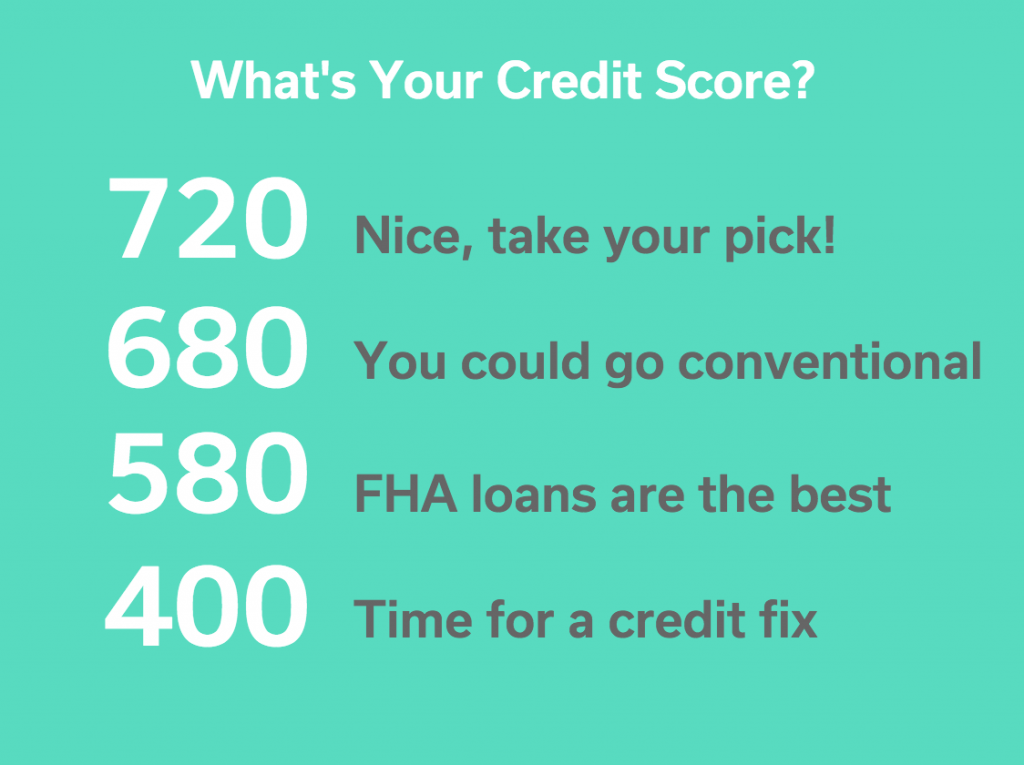

A FICO of 620 is typically the minimum credit score needed to buy a house Ishbia says though some lenders will.

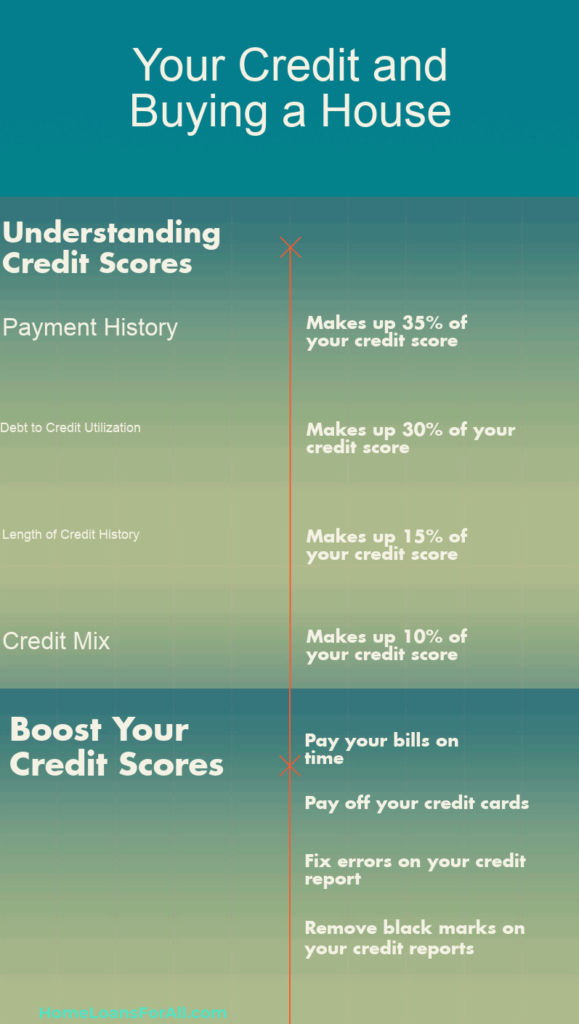

. Lenders generally take into account FICO Score ranges ie 620 660 700 and having a score in a higher range could save you thousands of dollars over the life of a mortgage loan. Does owning property increase credit. At the start it will determine which loan options you can even consider as a homebuyer.

These large home loans exceed conforming limits set by Freddie Mac and Fannie Mae. Owning a home in and of itself. The higher your score the better the chance you have of getting the mortgage youre after.

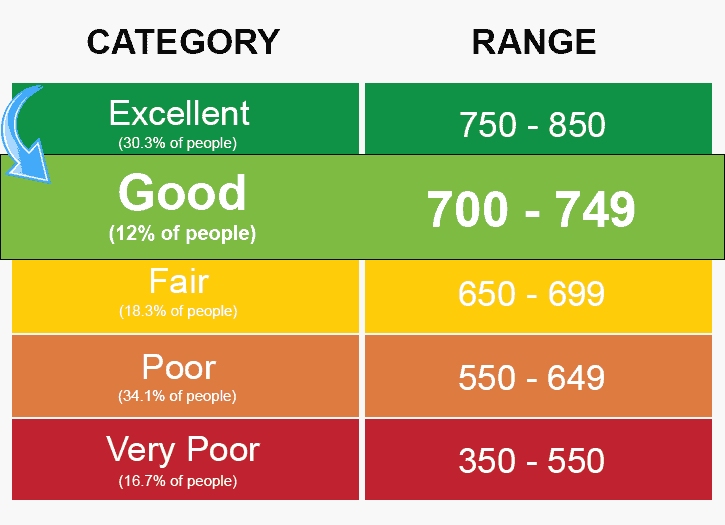

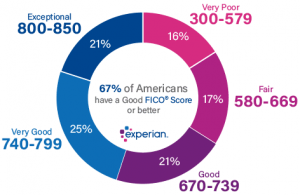

But what credit scores do people getting mortgages actually have on. Credit scores range from 300 to 850 and are often crucial to the homebuying process. If youre planning to buy a home your credit score will play a big part in the process.

What is a good credit score to get a mortgage. Second mortgage lenders are bound by specific rules which determine what credit scores you need to buy a house and those rules vary by your loan type. The credit score needed to buy a house depends on the type of mortgage loan youre applying for and your lender.

In Australia its usually a rank between 0 and 1200 depending on the credit agency. A LendingTree study showed that borrowers with a fair score 580-669 pay significantly more in interest than those in the very good range 740-799. It runs from 0-999 and can give you a good idea of how lenders are likely to view you.

Since your score represents your trustworthiness to lenders youre likely to get a good deal on a loan the better it is and that means paying less money for your mortgage. VA Loans Veterans of the military are eligible for VA loans. The Department of Veterans Affairs does not do not have a minimum credit score requirement to guarantee a loan.

Unless youre a year or more from buying a home opening new lines of credit would actually do more harm than good. Learn the average credit score to buy a house. While its possible to get a mortgage loan with bad credit you typically need good or exceptional credit to qualify for the best terms.

Credit inquires applications for new lines of credit have a. The purchased home must be in a rural area with lenders typically requiring a credit score from 520 to 640. While you dont need a perfect 850 credit score to get the best mortgage rates there are general credit score requirements you will need to meet in order to take out a mortgage.

For example some mortgage lenders may prefer to deal only with applicants with credit scores above 740considered very good or exceptional on the FICO Score scale range of 300 to 850 while others may specialize in subprime mortgages aimed at applicants who have lower credit scores. You might be tempted to build up your credit score by opening new credit cards or even taking out a loan before you apply for a mortgage. While some loan types require minimum scores as high as 640 conventional loans others go down to 500 some FHA loans.

The lowest down payment is 35 for credit scores that are 580 or higher. Keep in mind that generally the lower your credit score the higher your interest rate will be which may impact how much house you can afford. You make sure your score is good enough to qualify for a home loan and then the purchase pushes your number down.

That drop averages 15 points although some consumers can see their score slide by as much as 40 points according to a new study by LendingTree. Your name current and previous. The Experian Credit Score is based on the information in your Experian Credit Report.

What are the four categories of a credit report. Also Know can I get a home loan with a 500 credit score. Does buying a house drop your credit score.

The average credit score to buy a house in 2020. Many lenders offer a catalog of mortgage products designed for applicants with. Several factors are evaluated to determine your credit score and conventional and government-backed loans have different credit score requirements.

If you have a credit score in the 500s your best chance for a home loan will be one insured by the Federal Housing Administration. Do not do this. A credit score sometimes referred to as a credit rating is used by lenders as a guide for how responsible a person is with money and whether they qualify for a home loan.

Generally speaking to get maximum financing on typical new home purchases applicants should have a credit score. What can be included in your credit report quizlet. If your credit score is between 500-579 you may still qualify for an FHA loan with a 10 down payment.

It also doesnt include your credit score. Credit Score Needed To Buy A House By Loan Type Your credit score is a number that ranges from 300 850 and that is used to indicate your creditworthiness. Go down to 580 or below.

Likewise what credit score do you need to buy a house 2020. Lenders use their own credit requirements. You need a580 credit score to buy a house using an FHA loan.

Average Credit Score The average credit score for buying a home is 680-739. Houses in a row with a field in the foreground. Your credit report does not include your marital status medical information buying habits or transactional data income bank account balances criminal records or level of education.

For qualified buyers purchasing a home in designated rural areas there is no set minimum credit score from the USDA. In a Nutshell Different types of mortgages have different requirements for the minimum credit score you need to qualify. On the credit score scale which ranges from 350-850 conventional loans require a credit score of at least 620.

A 10 down payment is required for borrowers with at least a 500 score. However a credit score of at least 640 is recommended. Its just a number but it can be the difference between being able to buy a house or not.

Conventional loans are the most common loan type.

What Credit Score Is Needed To Buy A House Updated For 2018

Can I Buy A House With A 700 Credit Score Experian

Myth You Need Great Credit To Buy A Home Homie Blog

What Is A Good Credit Score To Buy A House Or Refinance In 2019

What Credit Score Is Needed To Buy A House Marcus By Goldman Sachs

What Should My Credit Score Be To Buy A House Youtube

-png.png)

0 Response to "what does your credit score have to be to buy a house"

Post a Comment